Vaccine bonds give Japanese retail investors a special investment opportunity

- Press Releases

- Vaccine bonds give Japanese retail investors a special investment opportunity

Vaccine bonds give Japanese retail investors a special investment opportunity

5 February 2009

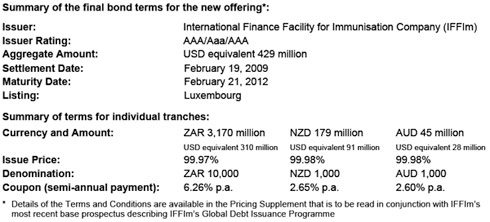

Vaccine bonds offered to Japanese retail investors in three currencies will raise USD 429 million equivalent to help pay for health and immunisation programmes in the world’s poorest countries.

Multi-tranche bonds raise USD 429 million equivalent, including the largest South African rand denominated uridashi bond to date

Tokyo, 5 February 2009 - Vaccine bonds offered to Japanese retail investors in three currencies will raise USD 429 million equivalent to help pay for health and immunisation programmes in the world's poorest countries.

"As with last year's debut transaction, it provides a wonderful opportunity for Japanese investors to benefit the lives of millions of the world's children," said Vince Purton, Managing Director, Daiwa Securities

Japanese investors' growing support for IFFIm

The vaccine bonds of the International Finance Facility for Immunisation Company ("IFFIm") will raise almost twice as much as IFFIm's debut uridashi launched last year. This exceptional result in challenging market conditions shows Japanese investors' growing support for IFFIm and its humanitarian purpose. IFFIm raises funds that are used by the GAVI Alliance for health and immunisation programmes in 70 of the poorest countries to protect millions of children against preventable diseases. This vaccine bond offering for the Japanese market was arranged by Daiwa Securities SMBC Co. Ltd., the wholesale securities firm under Daiwa Securities Group, and distributed by Daiwa Securities to Japanese investors.

Investors were given the opportunity and choice of investing in vaccine bonds denominated in three currencies: South African rand ("ZAR"), New Zealand dollars ("NZD"), and Australian dollars ("AUD"). The currencies were selected based on investor demand. The ZAR tranche is the largest ZAR-denominated uridashi bond to date.

Meeting international development needs through investments

This second vaccine bond issue comes at a time when investor demand for ethical investment products of the highest credit quality is growing in the Japanese retail market. IFFIm's financial base is composed of long-term donor commitments from seven sovereign countries (France, Italy, Norway, South Africa, Spain, Sweden and the United Kingdom). With prudent financial management by the World Bank as IFFIm's treasury manager, IFFIm is able to raise funds from investors through vaccine bonds for the GAVI Alliance to immediately purchase vaccines and help strengthen related health systems. By "frontloading" funds to the GAVI Alliance, vaccine bonds help prevent and cut the spread of diseases to save more lives. The enthusiastic investor response to the vaccine bond shows that the Japanese retail investors continue to seek social and financial returns for their investments. Alan Gillespie, Chairman the IFFIm Board: "This level of subscription from the Japanese capital market reflects strong demand for investments which offer a market rate of return and also offer investors the deep satisfaction of knowing that their money will be used for a very good purpose - in this case saving children's lives. We are very grateful to Daiwa Securities and the Japanese investing public for helping us to raise significant additional funds for immunisation."

Alice Albright, Chief Financial and Investment Officer of the GAVI Alliance: "Once again, we are very grateful for the strong support of Japan's capital market. The proceeds from this issuance will enable GAVI to help the world's poorest countries protect their children from a number of deadly diseases including hepatitis B, Haemophilus influenzae type b (Hib), measles, polio, and yellow fever as well as help strengthen the systems required to deliver these vaccines."

Kenneth Lay, Vice President and Treasurer of the World Bank: "The World Bank has been an issuer in the Japanese capital markets for more than 35 years. We are pleased to be working with IFFIm to help offer Japanese investors this opportunity to make a difference in millions of children's lives."

Vince Purton, Managing Director, Debt Capital Markets Daiwa Securities SMBC Europe Ltd.: "We are delighted to have brought this new investment opportunity to the Japanese financial community. The issue size is larger than expected and this is a testament to the powerful and socially responsible message involved which, even in tough market conditions, has struck a positive chord with key investors. As with last year's debut transaction, it provides a wonderful opportunity for Japanese investors to benefit the lives of millions of the world's children."

About the GAVI Alliance

The GAVI Alliance is a public-private partnership that aims to immunise children and strengthen health systems in the world's poorest countries. It brings together developing country and donor governments, the World Health Organization, UNICEF, the World Bank, the vaccine industry in both industrialised and developing countries, research and technical agencies, NGOs, the Bill & Melinda Gates Foundation and private philanthropists. GAVI provides vaccines against diphtheria, tetanus, pertussis combined with haemophilus influenzae type b and hepatitis B as so-called pentavalent (five antigens in one vaccine) as well as vaccines against measles, yellow fever, pneumococcal diseases (pneumonia and meningitis) and rotavirus (diarrhoea).

About IFFIm

International Finance Facility for Immunisation Company (IFFIm) is a multilateral development institution created to accelerate the availability of predictable, long-term funds for health and immunisation programmes through the GAVI Alliance (formerly the Global Alliance for Vaccines and Immunisation) in 70 of the poorest countries around the world. IFFIm was created as a development financing tool to help the international community achieve the Millennium Development Goals. IFFIm's financial base consists of legally binding grants payments from its sovereign sponsors (France, Italy, Norway, South Africa, Spain, Sweden and the UK), on the basis of which IFFIm's is rated AAA/Aaa/AAA (Fitch/Moody's/S&P). The World Bank is the Treasury Manager for IFFIm. IFFIm was established as a charity with the Charity Commission for England and Wales and is registered in England and Wales as a company limited by guarantee with number 5857343 and as a charity with number 1115413.

About the World Bank

The World Bank is a global development cooperative owned by 187 member countries. Its purpose is to help its members achieve equitable and sustainable economic growth in their national economies and to find effective solutions to pressing regional and global problems in economic development and environmental sustainability. The goal is to help overcome poverty and improve standards of living for people worldwide. The International Bank for Reconstruction and Development (IBRD), rated Aaa/AAA (Moody's/S&P), is the oldest and largest entity in the World Bank Group and provides funding, risk management tools and credit enhancement to sovereigns. To fund this activity, IBRD has been issuing debt securities in the international capital markets for 60 years. The World Bank is also the Treasury Manager for IFFIm. In that capacity, the World Bank, as IFFIm's agent, manages IFFIm's finances according to prudent policies and standards. This includes IFFIm's funding strategy and its implementation in the capital markets, rating agency and investor outreach, hedging transactions and investment management. The World Bank also coordinates with IFFIm's donors and manages their pledges and payments as well as IFFIm's disbursements for immunisation and health programmes through the GAVI Alliance.

Media contacts:

Yoshiyuki Arima, World Bank (Tokyo)

Tel: 081 3 3597 6650

yarima@worldbank.org

Rachel Winter Jones, World Bank (Paris)

Tel: + 33.1.40.69.30.52

Mobile: +.33.6.23.14.17.45

Rjones1@worldbank.org

Paul Lyon/Caroline Klein (London)

Tel: + 44.207.597.8101

business.communication@daiwasmbc.co.uk

Hidekazu Kurihara, Hiroharu Misawa, Ryoji Fuchinoue, Yukiko Kishino,

Daiwa Securities Group (Tokyo)

Tel.+81.3. 5555.1165

publicrelations@daiwasmbc.co.jp

Disclaimer

This document is not an offer for the sale of securities. This document and the information contained herein is not for publication, distribution or release in, whole or in part, in or into, directly or indirectly, the United States.

This press release is not an offer for sale of Notes of the International Finance Facility for Immunisation Company ("IFFIm"), in the United States. The Notes are not being registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States or to US persons except pursuant to an applicable exemption from such registration. Any offering of the Notes will be made only by means of a prospectus containing detailed information regarding IFFIm and its management, including financial statements. Such prospectus will be made available through IFFIm. This press release does not constitute an offer for sale of the securities described. The offering and sale of the securities described in this document are subject to restrictions under the laws of several countries. Securities may not be offered or sold except in compliance with all such laws.

THIS DOCUMENT IS NOT AN OFFER FOR THE SALE OF SECURITIES. THIS DOCUMENT AND THE INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, IN WHOLE OR IN PART, IN OR INTO, DIRECTLY OR INDIRECTLY, THE UNITED STATES

Share this article

Restricted Access Library

The material in this Restricted Access Library is intended to be accessed only by persons with residence within the territory of a Member State of the European Union and is not intended to be viewed by any other persons. The material in this Restricted Access Library is provided by IFFIm for information purposes only and the materials contained herein were accurate only as of their respective dates. Certain information in the materials contained herein is not intended to be, and is not, current. IFFIm accepts no obligation to update any material contained herein.

The material in this Restricted Access Library is intended to be accessed only by persons with residence within the territory of a Member State of the European Union and is not intended to be viewed by any other persons. The material in this Restricted Access Library is provided by IFFIm for information purposes only and the materials contained herein were accurate only as of their respective dates. Certain information in the materials contained herein is not intended to be, and is not, current. IFFIm accepts no obligation to update any material contained herein.

Persons with residence outside the territory of a Member State of the European Union who have access to or consult any materials posted in this Restricted Access Library should refrain from any action in respect of the securities referred to in such materials and are otherwise required to comply with all applicable laws and regulations in their country of residence.

By clicking Access restricted content: DYNAMIC-LINK-TEXT I confirm that I have read and understood the foregoing and agree that I will be bound by the restrictions and conditions set forth on this page.

The materials in this Restricted Access Library are for distribution only to persons who are not a "retail client" within the meaning of section 761G of the Corporations Act 2001 of Australia and are also sophisticated investors, professional investors or other investors in respect of whom disclosure is not required under Part 6D.2 of the Corporations Act 2001 of Australia and, in all cases, in such circumstances as may be permitted by applicable law in any jurisdiction in which an investor may be located.

The materials in this Restricted Access Library and any documents linked from it are not for access or distribution in any jurisdiction where such access or distribution would be illegal. All of the securities referred to in this Restricted Access Library and in the linked documents have been sold and delivered. The information contained herein and therein does not constitute an offer for sale in the United States or in any other country. The securities described herein and therein have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with any applicable state securities laws.

Each person accessing the Restricted Access Library confirms that they are a person who is entitled to do so under all applicable laws, regulations and directives in all applicable jurisdictions. Neither IFFIm nor any of their directors, employees, agents or advisers accepts any liability whatsoever for any loss (including, without limitation, any liability arising from any fault or negligence on the part of IFFIm or its respective directors, employees, agents or advisers) arising from access to Restricted Access Library by any person not entitled to do so.

"Relief" for mothers in Bayelsa state as malaria vaccine makes waves

07 November 2025